If you manage sales across many regions or countries, you might think you have full control over your sales data. But often, this control is just an illusion. Even with advanced Enterprise Sales Automation tools, companies can collect huge amounts of data yet still fail to gain clear insights into what’s really happening in the field.

The problem? Sales data from different regions often looks very different, and is hard to compare or combine. This creates “Phantom Territories” — areas where sales performance is unclear or misunderstood. As a result, leaders make decisions based on incomplete or misleading information, losing money without realizing it.

In fact, studies show that companies with poor sales visibility lose nearly 30% of potential revenue every year. For big companies, this can mean billions of dollars in missed opportunities.

Why Regional Reporting Often Misses the Bigger Picture

Many big companies divide their sales into regions or territories. Each region reports its own numbers and progress. On paper, all looks well growth, healthy pipelines, and good sales cycles.

But in reality, regions can become isolated silos that don’t share important information. For example:

- One city’s team might be competing against a neighboring city for the same customers without knowing it.

- Another region may lose deals because they don’t get timely updates about competitor moves.

- Sometimes steady sales hide high customer churn rates, which can threaten future business.

This “Jurisdictional Myopia” — seeing only what’s happening within your assigned zone — causes critical blind spots that can derail enterprise-wide strategy.

To avoid this, large organizations need a scalable SFA platform that connects regional insights into a unified, intelligent system.

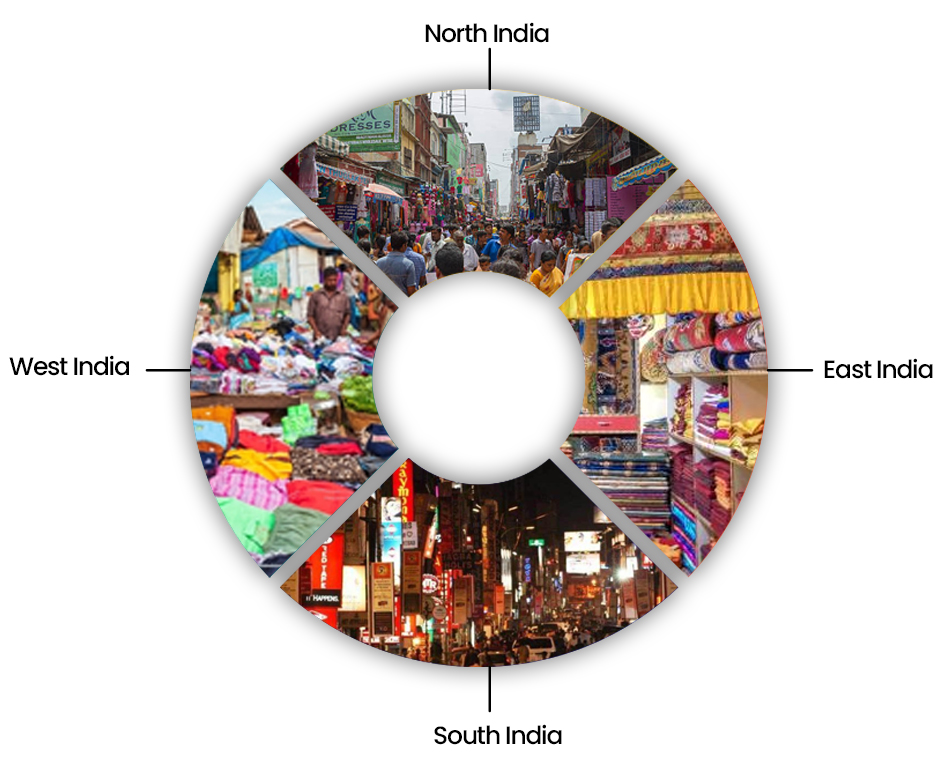

The Complexity of India’s Diverse Market

India is one of the most complex markets to manage because of its size and diversity. Sales teams there deal with many different types of customers, from small family businesses to large tech companies, all with their own ways of making decisions.

For example, in India, sales deals usually involve more people than in Western countries, sometimes 40% more decision-makers. But many sales tools don’t capture this complexity, so companies don’t get an accurate picture of their progress.

Other factors also vary regionally in India:

- In metro cities, payment terms might be 30 days, while in smaller towns, they can extend to 90–120 days.

- Decision-making structures vary by industry and region.

- Seasonal events like the monsoon or major festivals affect buying patterns differently.

Generic Sales Force Automation for large companies often ignores these differences, leading to inaccurate forecasting and poor territory management.

The Cost of Information Hoarding and Poor Collaboration

In many organizations, regions protect their own information because their budgets and bonuses depend on positive results. This leads to information hoarding — teams sharing only good news and hiding challenges.

A good example comes from a software company’s India operations. The Bangalore team created a new sales strategy that boosted their revenue by over 300%, but they kept it to themselves for many months. Other teams missed out on this winning approach, and the company lost millions in potential sales.

Failing to share successful strategies across teams stalls organizational progress and results in significant lost potential.

Activity vs Results: Understanding Real Sales Momentum

Many sales dashboards focus on easy-to-measure activities: number of calls, emails, meetings, or pipeline size. But these “lazy metrics” can trick managers into thinking sales are moving fast when they are not.

Take a pharmaceutical company’s Mumbai office, for example. They had:

- Over 500 prospect meetings every week

- Increasing pipeline values

- Shorter sales cycles

Despite all this, their market share was shrinking, customer satisfaction was dropping, and competitors were winning deals. Why? Because more activity didn’t translate into real sales wins.

This shows the danger of confusing motion (doing a lot of activities) with momentum (making real progress). True sales velocity means understanding the quality and context of activities, not just their quantity.

In India’s pharma market, relationship-building often takes much longer due to complex hospital decision structures. A short sales cycle might mean the relationship wasn’t strong enough, leading to contract problems later.

Companies that adjust their velocity measurements for these local realities improve forecast accuracy by 45% and win rates by 28%.

Building Context-Aware Sales Intelligence Systems

To overcome these challenges, companies need to build contextual normalization into their sales data systems. This means:

- Viewing sales data from each region in its local context, but also comparing it fairly with other regions

- Integrating data from many different sources and systems into one clear picture

- Accounting for cultural, operational, and seasonal differences when analyzing data

Companies that do this see a 60% improvement in forecast accuracy and reduce wasted resources by 40%.

India’s diverse markets make this especially important. Payment terms, decision structures, and buying seasons vary widely even within the country, so treating all regions the same leads to mistakes.

Creating Powerful Feedback Loops for Organizational Learning

One big missing piece in many companies is closed-loop feedback — a way to share lessons learned in one region with all others quickly and effectively.

For example, a manufacturing company in Chennai discovered a new sales approach focused on financing for small businesses, which boosted revenue by 450% in a year. When they shared this with their global teams, it helped generate over $180 million extra revenue worldwide.

Feedback loops like this multiply the value of innovations and help the whole organization learn faster.

To build them, companies need:

- Real-time platforms that share knowledge without overwhelming users

- Incentives that reward teams not just for their own sales but for helping others

- Cultural programs that encourage teamwork across regions

Companies with strong feedback loops enter new markets 35% faster and win new territories 50% more often.

The Future: Merging AI with Human Understanding

Artificial intelligence (AI) is changing the game by spotting patterns and trends humans might miss. Especially in complex markets like India, AI can:

- Understand sales conversations

- Recognize cultural buying patterns

- Predict demand based on festivals, weather, and economic trends

- Map complex stakeholder relationships

Companies using AI in sales visibility improve lead quality by 55% and allocate resources 42% better.

But technology alone isn’t enough. The best companies blend AI’s power with human understanding of culture and market context. This combination leads to 85% higher user adoption of sales tools and 60% better returns on investment.

Conclusion

True sales visibility across diverse and complex markets like India isn’t just an advantage; it’s the foundation for winning in today’s fiercely competitive landscape.

PepUpSales specializes in Enterprise SFA and scalable SFA for large companies, particularly those operating in complex markets like India. Whether you’re in FMCG, pharma, or retail, our solutions are built to help you normalize sales data, improve multi-regional collaboration, and optimize outcomes with AI-powered insights.

Ready to see how PepUpSales can transform your sales operations? Schedule a free demo today and take the first step toward becoming a truly visible and agile sales organization.