Are you struggling to boost your primary sales numbers in the FMCG sector? You’re not alone. We’ve worked with countless brands and distributors who face this exact challenge every day. Because, without strong primary sales (those crucial transactions between manufacturers and distributors), everything else in your sales funnel becomes an uphill battle. While everyone talks about secondary and tertiary sales, it’s those primary sales that directly feed your revenue and create the foundation for everything that follows.

In this blog, we’re cutting through the noise to share practical, proven strategies that can transform your primary sales performance. Whether you’re a brand looking to move more products to distributors or a distribution partner aiming to optimize your ordering processes, these tips will help you create sustainable growth in today’s ever-changing FMCG landscape.

Understanding the Primary Sales Ecosystem

Primary sales represent the first crucial transaction in the FMCG supply chain, where manufacturers sell products to distributors. These transactions form the foundation of a brand’s revenue stream and determine product availability in the market. However, primary sales don’t exist in isolation—they’re influenced by downstream activities:

- Secondary sales performance affects distributor confidence and reorder rates

- Tertiary sales patterns indicate consumer demand that ultimately drives the entire chain

- Market conditions including seasonality, competition, and economic factors

For brands looking to maximize primary sales, recognizing this interconnected ecosystem is essential for implementing effective strategies.

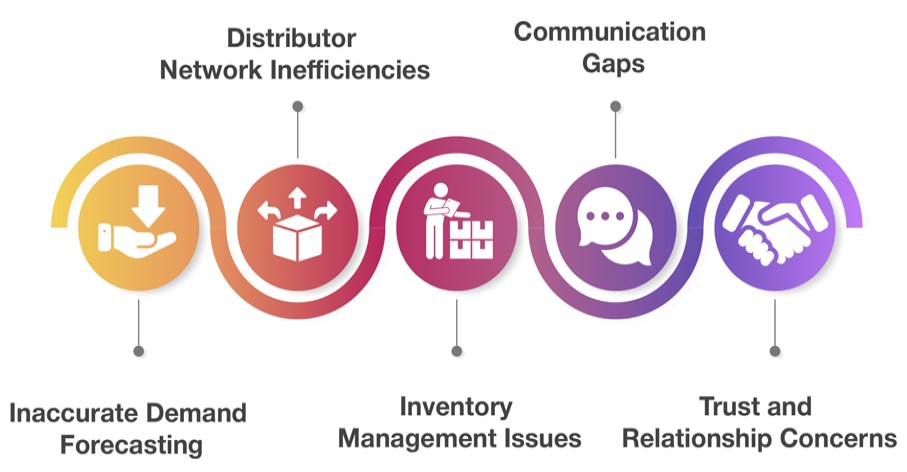

Key Challenges in Primary Sales

Before diving into improvement strategies, let’s examine the common obstacles that hinder optimal primary sales performance:

1. Inaccurate Demand Forecasting

When brands lack real-time market insights or rely on outdated data, they risk producing too much (leading to excess inventory) or too little (causing stockouts and revenue loss). This challenge is compounded by seasonal fluctuations, changing consumer preferences, and unexpected market disruptions. Many FMCG companies still rely on basic spreadsheets or historical averages rather than sophisticated predictive models, leaving them vulnerable to costly inventory mismatches.

2. Distributor Network Inefficiencies

Many brands maintain distributor relationships that underperform due to poor communication, misaligned incentives, or inadequate support systems. Performance metrics along with clear KPIs become essential for identifying distributors who require support or training because their absence creates challenges in assessment. The combination of overlapping and vacant geographic areas results in territory disputes that diminish network effectiveness and produce unattended potential market opportunities.

3. Inventory Management Issues

Manufacturers and distributors encounter inventory optimization challenges because they lack real-time access to stock levels throughout the distribution network. The frequent stockout of popular products occurs simultaneously with the accumulation of slow-moving items which ties up valuable working capital. The lack of automated supply management systems leads distributors to base their orders on guesswork instead of actual product usage metrics thereby maintaining an ongoing discrepancy between supply and customer needs.

4. Communication Gaps

Lacking integration between brand and distributor systems creates a chain of delayed information flow which generates misunderstandings and missed business opportunities. Important information becomes delayed or lost when sales teams use manual methods including phone calls and emails and spreadsheet systems. Distribution partners experience execution failures coupled with frustration because order changes and price updates and promotion details fail to reach their intended recipients on schedule.

5. Trust and Relationship Concerns

Brands who ignore distributor profitability and challenges while pushing their products create problems that damage long-term relationships. Distributors experience frustration because they believe manufacturers fail to grasp their operational requirements along with financial needs and market competition dynamics. When trust breaks down between manufacturers and distributors it produces three negative results: restrained orders and reduced market information exchange and reduced potential for joint business expansion. When distributor relationships are weak they will choose competing brands which provide superior support and better margins.

Strategic Approaches to Boost Primary Sales

1. Implement Advanced Demand Forecasting

Modern FMCG brands can’t rely on historical data alone. Implement smart forecasting systems that incorporate seasonal demand patterns, market trends and competitor activities, economic indicators affecting purchasing power, secondary sales data from distributors, and consumer behavior insights. Companies that leverage predictive analytics typically improve forecast accuracy by 20-30%, directly impacting production planning and inventory management.

2. Optimize Distributor Management Systems

Streamline ordering processes with digital tools that enable real-time inventory visibility, automated reordering based on predefined thresholds, digital invoice management and payment tracking, and performance analytics on distributor effectiveness. These systems reduce order processing time by up to 70% while minimizing errors that can damage distributor relationships.

3. Design Strategic Distributor Incentive Programs

Rather than generic volume-based incentives, develop sophisticated programs that reward consistent ordering patterns over time, incentivize distributors to expand into new territories, provide additional benefits for promoting specific product lines, and offer tiered rewards based on multiple performance metrics. Well-designed incentive programs can increase distributor engagement by 40-50% and directly boost primary sales volume.

4. Provide Value-Added Services to Distributors

Forward-thinking FMCG companies go beyond transactional relationships by offering comprehensive support to their distribution partners.The company delivers essential market insights together with consumer data that enables distributors to develop strategic stock and sales plans. The investments made by companies in distributor capabilities through sales training and development programs along with merchandising materials drive improved product visibility at retail. Joint business planning meetings between organizations build stronger partnerships through strategic goal alignment. The added value services manufacturers provide, create lasting partnerships that shift their position from suppliers to strategic business partners thus building distributor loyalty and raising order frequency.

5. Implement Data-Driven Territory Management

Your distribution network optimization requires territory mapping that considers market potential along with distributor capability assessment for requirement matching and individual territory goal definition and continuous performance evaluation to adjust strategies. A well-managed territory system provides complete market reach while eliminating conflicts between distribution channels which obstruct primary sales growth.

6. Enhance Inventory Management Practices

Both brands and distributors can improve primary sales efficiency through implementing automated inventory tracking systems, adopting just-in-time ordering practices, establishing optimal stock levels for different product categories, and using data analytics to identify slow-moving inventory. Effective inventory management reduces carrying costs while ensuring availability for secondary sales opportunities.

7. Develop Strong Retailer Relationships

Distributors serve as the crucial link between brands and retailers. Building robust retailer networks enables more accurate demand forecasting, higher secondary sales conversion, better feedback on market trends, and increased confidence in primary order placement. Distribution partners who maintain strong retailer relationships typically achieve 15-20% higher order values from manufacturers.

8. Invest in Sales Force Automation

Modern distribution requires technological support through mobile order management systems, GPS-enabled route optimization, digital catalog and pricing tools, and performance tracking dashboards. These investments increase sales team productivity by 25-30% on average, allowing for more retailer visits and order collection.

Conclusion

So, what’s the bottom line? Boosting your primary sales isn’t rocket science, but it does require a smart, coordinated approach. It’s about building relationships, leveraging the right technology, and making decisions based on real data rather than hunches.

Remember, primary sales aren’t just about pushing more products to your distributors. They’re about creating a well-oiled machine where everyone—from your production team to your distributors and retailers—works together smoothly to keep products moving through the pipeline.

At PepUpSales, we help customers boost their primary sales by providing them an integrated platform consisting of SFA, DMS, van sales, and visual merchandising solutions. Our technology streamlines distributor management, provides real-time analytics, and enables seamless communication between all stakeholders in your supply chain.

Why keep struggling with outdated systems? Schedule a free demo today and discover how our tailored solutions can help you achieve your primary sales targets and drive sustainable growth.