Ever walked into your favorite cafe and wondered about the journey of that packet of coffee beans or tea before it reached your cup? Or perhaps you’ve stayed at a hotel and used those tiny shampoo bottles without thinking about how they got there? Well, that journey often involves what industry insiders call “HoReCa” – a critical channel that’s reshaping how consumer goods brands operate.

In 2023, the HoReCa market was worth a massive $3.02 trillion, and it’s expected to grow to nearly $3.88 trillion by 2030. The beverage segment alone was valued at $155 billion and is set to grow steadily at 3.5% per year between 2024 and 2032.

These aren’t just impressive figures; they’re a wake-up call for FMCG brands. Industry giants have already taken notice – major food companies derive significant revenue from HoReCa by providing bulk ingredients and specialized solutions. Beverage corporations leverage strategic partnerships with fast-food chains and cafes, while other consumer goods manufacturers supply specialized products such as cheese packs and bakery items.

What is HoReCa? and why should FMCG brands care?

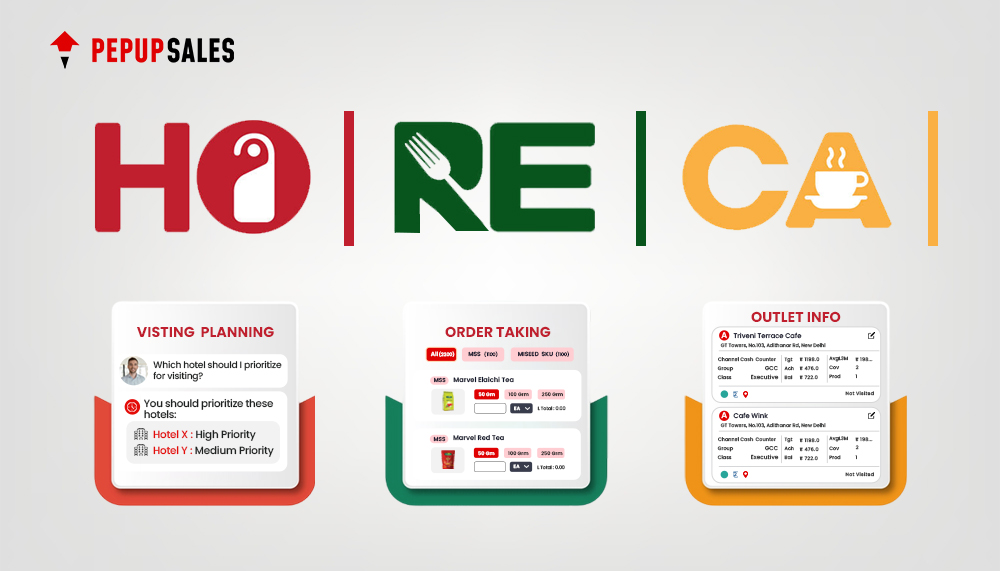

HoReCa is an acronym that stands for Hotels, Restaurants, and Cafes/Catering. Together, these segments form the backbone of the food service and hospitality industry. It represents a significant distribution channel where food, beverages, and other consumer goods flow from manufacturers to end consumers through hospitality establishments rather than retail outlets.

The HoReCa sector is characterized by its unique business dynamics, purchasing patterns, and consumer touchpoints that differ markedly from traditional retail channels. For FMCG brands, this represents a parallel route to market with distinctive advantages and requirements.

Hotels

Hotels encompass a diverse range of establishments from budget accommodations to luxury resorts, boutique hotels to international chains. Each type serves different guest segments with varying expectations, but all share common needs for quality consumer goods.

Within hotels, FMCG products appear in multiple touchpoints: guest rooms feature toiletries, minibars stock beverages and snacks, restaurants require ingredients and packaged goods, and breakfast buffets showcase branded food items. The hotel segment of HoReCa often involves volume purchasing through centralized procurement systems, especially in chain establishments.

Restaurants

Restaurants represent perhaps the most diverse segment of HoReCa, spanning from quick-service establishments to fine dining venues, family-style eateries to specialized ethnic cuisines. This diversity creates numerous entry points for FMCG brands across different product categories and price points.

Restaurants rely on FMCG products throughout their operations: kitchen ingredients form the foundation of menu items, packaged beverages complement the dining experience, and branded condiments often sit directly on tables. The purchasing dynamics in restaurants can vary dramatically based on size and structure.

Cafes/Catering Services

Cafes have evolved from simple coffee shops to multifaceted social hubs where people gather, work, and relax. This transformation has expanded their requirements for FMCG products beyond just coffee and tea to include a wide range of food items, alternative beverages, and snacks.

The cafe environment offers FMCG brands particularly strong opportunities for brand storytelling and direct consumer engagement. Meanwhile, catering services represent a high-volume, event-driven segment of HoReCa requiring reliable access to consistent, quality products that can be prepared at scale for corporate events, weddings, and other gatherings.

Why HoReCa Matters for FMCG Brands

The HoReCa channel offers exceptional volume potential for FMCG brands, with establishments purchasing in bulk and with greater frequency than individual consumers. A single hotel chain contract might represent thousands of retail customers, providing stable, predictable demand that optimizes production planning and supply chains. When consumers encounter products in upscale hotels or trendy restaurants, these environments confer a quality halo effect, creating emotional connections and memorable brand experiences that traditional retail rarely achieves.

Products in HoReCa typically command higher margins than retail counterparts, reflecting the value of specialized formulations, exclusive variants, or complementary services. This premium positioning allows brands to showcase products in ideal consumption moments – served at perfect temperatures, in expert pairings, or with professional presentation that highlights quality attributes. The channel creates opportunities for premium brand storytelling that packaging or advertising alone cannot deliver.

HoReCa partnerships provide valuable market intelligence on emerging consumer preferences before they become mainstream. Chefs and mixologists often experiment with new flavors and combinations that later influence retail trends. This allows brands to test concepts in limited settings before full-scale launches, reducing innovation risks. Additionally, maintaining positions in both retail and HoReCa channels provides strategic resilience against market fluctuations, as these channels often experience complementary demand patterns during economic shifts, creating a more balanced business model for forward-thinking FMCG companies.

Key Challenges and Solutions in the HoReCa Channel

The HoReCa channel presents unique obstacles that FMCG brands must navigate to truly capitalize on this $3.88 trillion opportunity. Let’s explore these challenges and their practical solutions:

1. Inefficient Lead Management and Customer Onboarding

Ever wondered why some FMCG brands struggle to gain traction in the HoReCa space despite having excellent products? The answer often lies in poor lead management and onboarding processes. Without proper customer profiling that considers location, sales potential, cuisine type, and other relevant factors, brands frequently waste resources pursuing misaligned partnerships – like pitching Chinese sauces to Texan restaurants where the culinary needs simply don’t match.

Manual lead assignment compounds this problem, introducing errors, delays, and inconsistencies throughout the pipeline. When sales representatives rely on handwritten notes and memory rather than structured systems, critical information falls through the cracks. There’s no dependable mechanism to assign appropriate experts for demonstrations or to systematically move prospects through the sales funnel.

Solution:

Digitize your lead management and customer onboarding systems to transform these processes. Modern field sales applications can ensure accurate profiling by using pre-defined factors to verify alignment between your offerings and potential HoReCa customers. These systems can automatically assign leads to the right team members, schedule technical demonstrations, and track pipeline progress in real-time.

This structured approach not only eliminates manual inefficiencies but also creates a seamless collaborative environment where sales teams and technical experts work together toward common conversion goals.

2. Sub-optimal Post-onboarding Relationship Management

Successfully onboarding a HoReCa customer marks just the beginning of what should be a long-term partnership. Yet many FMCG brands falter at this critical juncture. Without integrated systems that bridge lead acquisition and relationship management, communication gaps inevitably emerge. Customer needs go unaddressed, service quality fluctuates, and valuable opportunities for deepening engagement through upselling or cross-selling never materialize.

The problem often stems from fragmented digital ecosystems – sales teams juggle multiple applications that don’t communicate with each other, creating information silos that prevent holistic customer understanding. When half your workflow lives in one system and half in another, consistent relationship management becomes nearly impossible.

Solution:

Implement a unified system that integrates both lead management and relationship management functionalities. By centralizing customer data captured throughout the acquisition journey, your sales teams gain the comprehensive insights needed to deliver personalized experiences that build loyalty.

Such platforms enable proactive service, consistent communication, and strategic opportunity identification across the customer lifecycle. This unified approach allows sales representatives to focus on meeting targets while ensuring managers can effectively monitor activities, identify process gaps, and take corrective actions before minor issues escalate into relationship-threatening problems.

3. Ineffective Visit Hygiene

In the relationship-driven HoReCa channel, face-to-face interactions remain irreplaceable – but not all visits deliver equal value. Many brands struggle with visit management, either through inconsistent scheduling or failure to optimize the productivity of each customer interaction. Sales cycles in this sector typically involve complex combinations of phone calls and physical meetings, making systematic tracking essential.

Without structured visit planning and documentation, sales teams often fall into counterproductive patterns – over-visiting some customers while neglecting others, failing to follow through on commitments, or missing opportunities with key accounts. This disorganized approach wastes valuable time and ultimately damages both operational efficiency and customer relationships.

Solution:

Deploy a dependable visit management system that tracks not just where your sales representatives go, but how productively they engage with each customer. Modern field sales platforms use AI-driven insights to identify high-potential HoReCa establishments worthy of additional attention, while streamlining workflows to maximize effectiveness during each interaction.

These systems provide managers with powerful reporting tools to analyze visit patterns, identify performance gaps, and implement targeted coaching interventions. By establishing clear visit hygiene protocols, brands can dramatically improve both sales efficiency and customer satisfaction.

4. Manual Ordering and Lack of Transparency

Picture this scenario: a sales representative visits a busy restaurant, jots down a complex order on paper, promises delivery dates based on rough estimates, then returns to the office to manually enter this information into company systems. This outdated process invites errors at every step – orders get misplaced, quantities are incorrectly recorded, and promised delivery dates are missed without appropriate notifications.

The situation worsens when dealing with perishable items or time-sensitive deliveries that require precise logistics coordination. Without real-time visibility into order status and fulfillment progress, both internal teams and HoReCa customers operate in frustrating information vacuums that undermine trust and operational efficiency.

Solution:

Enable digital ordering capabilities for both your sales team and direct customer use. Modern platforms provide intuitive interfaces where users can clearly view available products, applicable promotional schemes, pricing details, and real-time order status updates. This transparency transforms the ordering process from a potential point of friction into a competitive advantage.

Consider the busy café that unexpectedly runs low on coffee beans between scheduled sales visits – digital self-ordering capabilities keep them loyal to your brand rather than driving emergency purchases from competitors. This approach not only preserves revenue streams but strengthens customer relationships through reliability and convenience.

5. Product and Scheme Communication Failure

New product launches and promotional schemes represent significant investments for FMCG brands – yet these initiatives frequently underperform in the HoReCa channel due to communication breakdowns. When sales representatives must personally introduce every new offering or promotion during their limited visit windows, valuable time that could be spent building relationships or closing sales is instead consumed by basic information sharing.

Without systematic digital communication channels, sales teams face impossible memory challenges – they must somehow retain perfect knowledge of countless product specifications and promotional details across diverse customer segments. Inevitably, this leads to inconsistent messaging, missed upselling opportunities, and incorrectly applied promotions that damage both revenue and customer trust.

Solution:

Deploy comprehensive digital sales enablement platforms with robust multimedia capabilities. These systems allow HoReCa customers to independently explore new products through engaging content while giving sales representatives instant access to detailed information tailored to each establishment’s specific needs.

By automating scheme applications and promotional calculations, these platforms eliminate human error while ensuring consistent implementation. This technological support frees your field teams to focus on relationship building and strategic selling activities that drive meaningful business growth.

Conclusion

The HoReCa channel represents a massive opportunity for FMCG brands – a $3.88 trillion opportunity by 2030, to be precise. But capturing this market requires more than traditional sales approaches. It demands specialized strategies, digital tools, and a deep understanding of the unique needs of hotels, restaurants, and cafes.

By addressing common challenges in lead management, relationship building, visit planning, ordering processes, and communication, brands can establish themselves as valued partners to HoReCa businesses. Those that embrace best practices and stay attuned to emerging trends will find themselves well-positioned to thrive in this dynamic and rewarding channel.

The journey from factory to hotel amenity, restaurant ingredient, or café offering may be complex, but with the best sales automation tools, it becomes significantly more efficient. PepUpSales empowers FMCG brands with real-time tracking, streamlined order management, and seamless communication tools, helping sales teams build stronger relationships and boost efficiency in the HoReCa sector. With powerful insights and automated workflows, businesses can reduce manual efforts and focus on growth.Want to see how PepUpSales can optimize your HoReCa sales strategy? Schedule a free demo today!